Has Someone Stolen Your Identity?

How to reduce your risk of identity theft and take action if you're a victim.

Are you getting bills for things you didn’t buy or phone calls from debt collectors for payments on accounts you didn’t know about?

You’ve likely been the victim of identity theft, where someone has stolen and is using your personal or financial information.

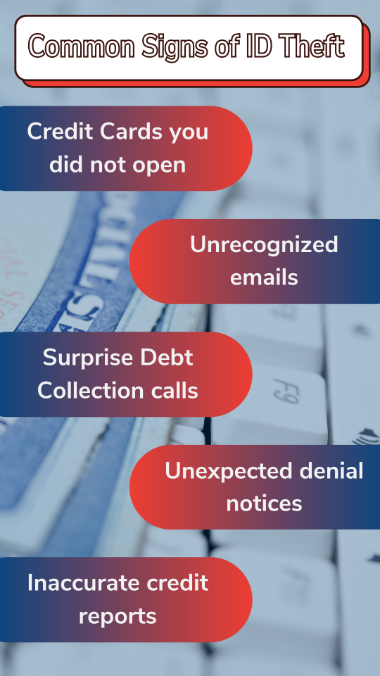

Other warning signs include seeing suspicious activity on your financial accounts or credit reports that you didn’t authorize, getting credit denial letters, and realizing some of your regular mail isn’t being delivered anymore.

In 2023, more than 1 million identity theft cases were reported to the Federal Trade Commission, with the most common being credit card fraud. Opening new credit accounts has become the MO of most thieves because data breaches have made your information more available.

Take Action

If you've been a victim of identity theft, here are ways you can take action:

- Report the identity theft to the Federal Trade Commission online at identitytheft.gov or call 877-438-4338.

- Contact the three major credit reporting agencies — Equifax, Experian and TransUnion — to put free fraud alerts and credit freezes on your accounts. With a fraud alert, creditors must verify your identity before opening a new account. With a credit freeze, you can still use your accounts, but no new accounts can be opened in your name. To lift the freeze temporarily (if you’re applying for a loan, new job or other reasons), you need to contact each credit bureau and follow the instructions to verify your identity.

- Notify your financial institutions, credit card issuers and any other entity where you have accounts that you’ve been a victim of fraud.

If you have a checking account with Mid American Credit Union, you have extra protection through our free victim resolution service. - Monitor your credit reports. You’re entitled to one free report every year from each of the three credit reporting agencies. Annualcreditreport.com is the only federally authorized source for those free reports. If you make a request to a different agency every four months, you can get year-round monitoring.

Ways to Protect Yourself

To help reduce your risk of identity theft, here are some things you can do:

- Don’t share your bank account numbers, Social Security number or other types of account and personal information to someone who calls, texts or emails you. Your credit union or bank already has that information, so they wouldn’t call, text or email you for that. Avoid responding to emails that ask you to click on links to verify information. Don’t give in to callers who make high-pressure demands for that information.

- Store documents securely at home. Don’t carry your Social Security card in your wallet; if you need it for a specific reason, put it back in a secure place after you’ve used it.

- Limit which credit cards you use for online purchases. It’s easier to track activity on one or two cards.

- Check your banking and credit card statements regularly to monitor activity. If you get statements by regular mail, note when they are delivered; if they don’t arrive on time, follow up with the company. Choose paperless or e-statements to reduce the risk of paper statements being intercepted.

Many financial and credit institutions have apps where you can get quick, real-time access. Some even allow you to put restrictions on using your debit or credit cards, like Mid American’s Card Manager app. - Shred receipts, unsolicited applications for cards or loans, bank or medical statements or other such documents.

- Use unique, strong passwords for each online account and a two-factor authentication process for online accounts. To track passwords, use an online password manager or app. With two-factor authentication, you’ll need to provide a second type of verification, like a code sent to your email or phone.